C.H. Robinson Worldwide Extends its Asian Market Reach

Mumbai and Pune, India and Hong Kong, China Site Visits

July 24, 2012

By

Evan Armstrong

Key Personnel:

Chris O’Brien, Senior Vice President of Transportation

Jordan Kass, Executive Director – TMC, a division of C.H. Robinson

Adam Davis, General Manager of Asia Pacific TMC, a division of C.H. Robinson

Mark Hong, Managing Director of Asia Pacific

C.H. Robinson Worldwide Overview

C.H. Robinson continues to be one of the most profitable tier-one global third-party logistics providers (3PLs). With 2011 gross revenue of $10.3 billion, net revenue of $1.6 billion, and a global staff of over 8,300, C.H. Robinson commonly generates net income margins in excess of 20%. It manages a network of approximately 240 branch offices in North America, Europe, Asia, South America, Australia, and the Middle East. C.H. Robinson dominates the non-asset based domestic transportation management 3PL segment in the United States with a market share of over 22%. While 76% of C.H. Robinson’s net revenues are truck transportation related, it has solid domestic intermodal, international transportation management, food sourcing, fuel card services and fuel management, and supply chain management operations.

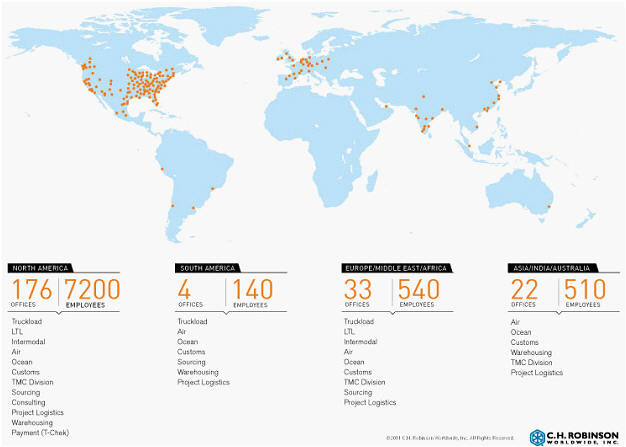

While approximately 8% of C.H. Robinson’s revenue is generated outside of the United States, it has been experiencing solid growth in its European and Asian operations. Its global operating network is detailed in the figure below.

C.H. Robinson Worldwide Global Operating Network

C.H. Robinson’s international transportation management, air, and ocean freight forwarding operations have grown substantially over the past 10 years and generated $106 million in net revenue in 2011. Annually it is managing over 260,000 ocean TEUs (20’ container equivalents) and 50,000 metric airfreight tons. C.H. Robinson uses a “gateway” strategy in constructing its freight forwarding operating network. Each gateway operation performs shipment consolidation and deconsolidation services in addition to its branch office freight forwarding functions. Gateway operations have been established in Amsterdam, Atlanta, Chicago, Hong Kong, London, Los Angeles, New York, and Shanghai. As part of its strategy, C.H. Robinson targets freight in specific trade lanes which incorporate a gateway operation. For example, Frankfurt, Germany to Chicago is a high volume airfreight lane and Hong Kong to Los Angeles is a sizeable air and ocean freight lane. In addition to freight forwarding, C.H. Robinson performs customs house brokerage services for an increasing number of shipments and has approximately 25 licensed customs brokers on staff in the U.S.

TMC, a division of C.H. Robinson, has also seen rapid global growth. It focuses on developing solutions for medium to large shippers seeking an engineered approach to managing large transportation networks. TMC has deployed its “Managed TMS” service supporting TMC’s worldwide operations by combining a single instance global transportation management system with TMS power users that operate from its four “Global Control Tower” operations in Chicago, Amsterdam, Mumbai, and Shanghai. It is long on transportation mode optimization, carrier routing compliance, carrier score-carding, service measurement and performance reporting, and initiating Lean Six Sigma process improvements. TMC is now managing approximately $2 billion in freight spend, processing over 3.2 million shipments annually, and has approximately 215 employees serving over 40 customers in the Americas, Asia, Africa, Europe, and the Middle East. Key TMC accounts include: Driscoll’s, Greenheck, Haworth, John Deere, Overstock, Starbucks, Subway, Smithfield, Tetra Pak, and the United States Postal Service.

Asian Operations History & Overview

C.H. Robinson began operating in Asia 20 years ago via agent relationships. In 2002 it invested directly by establishing C.H. Robinson Worldwide, Inc. (Hong Kong) Limited. Initially the Hong Kong office focused on ocean freight forwarding. In 2004, C.H. Robinson acquired Dalian, China based Dalian Decheng Shipping Agency Co., Ltd. (DDSA) adding freight forwarding/non-vessel operating common carrier (NVOCC) operations in Dalian, Tianjin, Qingdao, Shanghai, Ningbo, Xiamen and Shenzhen, China. In addition to its core ocean freight forwarding/NVOCC operations, C.H. Robinson added basic warehousing capabilities and airfreight forwarding to its service offering. In 2006, C.H. Robinson acquired Chennai, India based Triune Freight Pvt Ltd. Triune had approximately 160 employees working from 11 offices in India and performed air and ocean freight forwarding and customs clearance services. Between 2007 and 2008, C.H. Robinson opened offices in Singapore and Vietnam. In 2009, C.H. Robinson added to its Asia service offering adding intra-Asia over-the-road transportation management. It also added offices in Malaysia and Australia. The Asia region operating network is shown in the figure below.

C.H. Robinson Worldwide Asia Region Operations

C.H. Robinson’s existing Asia region operational footprint includes approximately 500 employees based in 25 operations in six countries and generates an A&A estimated $310 million of C.H. Robinson’s global revenues. Its current supply chain management service offering includes ocean freight forwarding/NVOCC, airfreight forwarding, project logistics, value-added warehousing, over-the-road transportation management, order management, and vendor management.

TMC manages two Global Control Towers in Asia. Its Mumbai and Shanghai offices were opened in 2009 and 2010 and are collocated with local branch offices.

Drink packaging manufacturer Tetra Pak is TMC’s largest global customer. It has worked with TMC in expanding globally to support Tetra Pak’s international manufacturing operations. TMC supports Tetra Pak’s manufacturing operations in Europe, India, Singapore, Japan, Thailand, Africa, the Middle East, North America, and South America.

As part of our visit to Mumbai, we traveled to visit Tetra Pak’s manufacturing operation in Pune to meet with its logistics management team. The details from our meeting are below.

TMC Customer Case Study – Tetra Pak Pune, India Visit

Tetra Pak is one of the three companies owned by privately held Swedish industrial group Tetra Laval. It has 43 global packaging material manufacturing plants and sold over 166 billion carton packages in 2011. On a global basis, Tetra Pak has an approximate freight spend of $400 million.

Tetra Pak’s packages are distributed to China which is it largest market. Brazil, and the United States and Canada are its second and third largest markets. Familiar drink brands using Tetra Pak cartons include Lipton Ice Tea, Minute Maid, and Tropicana juices. At Tetra Pak, logistics is viewed as a competitive advantage and dramatically impacts its environmental sustainability initiatives.

Tetra Pak’s packages are distributed to China which is it largest market. Brazil, and the United States and Canada are its second and third largest markets. Familiar drink brands using Tetra Pak cartons include Lipton Ice Tea, Minute Maid, and Tropicana juices. At Tetra Pak, logistics is viewed as a competitive advantage and dramatically impacts its environmental sustainability initiatives.

According to Sanjay Gokhale, manager of logistics and planning for Tetra Pak India, while overall carrier procurement was centralized prior to working with TMC, transportation management operations were very regionalized. Tetra Pak lacked a transportation management system and almost all transportation management processes were performed manually.

Shipment visibility was poor and carrier management was less than ideal often resulting in wasted hours finding backup carrier capacity. Local manufacturing plants manually booked transportation from carriers and had no shipment visibility after loaded trucks were dispatched. Carrier proof of delivery confirmations were secured manually and inadequate freight bill audit and payment processes resulted in duplicate freight bill invoices being paid. In addition, there was no event management or business intelligence/reporting.

Working with TMC, Tetra Pak adapted a Logistics Control Tower (LCT) approach to transportation management. Tetra Pak leverages TMC’s staff and transportation management system in supporting Tetra Pak’s global logistics operations.

The first Tetra Pak operation to adapt the LCT model with TMC was Wrexham, UK, in 2009. It has since been rolled out to Tetra Pak operations in Europe, the United States, Mexico, South America, India, Singapore, Thailand, Japan, Africa, and the Middle East.

Since working with TMC, Tetra Pak has automated most carrier load tendering, messaging and confirmations, and freight bill audit and payment processes. In addition, daily shipment planning and mode selection is being systematically optimized. According to Tetra Pak, it has seen significant savings in five key areas: 1. Increased outbound product trailer/container utilization (heavier payloads), 2. Improved carrier routing compliance, 3. Reduced airfreight and expedited shipment costs, 4. Improved carrier on time service performance, and 5. Improved shipment visibility. In addition, Sanjay and his team are very happy with TMC’s online business intelligence and reporting tools which have allowed them to better manage seasonal demand changes and carrier capacity shifts.

C.H. Robinson Asia – High-Value Equipment Merge-in-Transit & Distribution Case Study

In 2006, one of C.H. Robinson’s customers was evaluating logistics providers and contacted C.H. Robinson as part of its process. It was searching for a reliable strategic partner to improve supply chain management operations for its semiconductor test equipment.

Four main components are assembled to make a completed semiconductor test “system” (single test equipment unit). At the time, two of the components–the “main frame” and “test head”–were manufactured in the United States. The “Manipulator” was manufactured in both the U.S. and Germany. “Cooling cabinets” came from Malaysia and the Philippines. Each final assembled test system is valued at over one million U.S. dollars and requires special handling and transportation to minimize damages.

The assembly process initially involved bringing all of the equipment components into the United States, consolidating them and selling each system to their global client based on an ex-factory U.S. basis. C.H. Robinson’s customer was looking to re-engineer its supply chain and drive down costs which led it to begin evaluating a merge-in-transit program. The merge-in-transit program would allow it to ship components directly to customer destination airports from the multiple origins. From there, the components could be consolidated, assembled, and tendered to customers in 10 Asian countries as completed “systems”.

C.H. Robinson conducted a thorough due diligence process. It met with local airlines, ground handling agents, warehouse providers, and customs officials to determine the feasibility of the program. During its evaluation process, C.H. Robinson’s customer made a major change in its supply chain by outsourcing the configuration of the main frame and test head from its company owned facility in the U.S. and outsourced the process to its Suzhou, China manufacturing operation. Recognizing the impact of changing the country of origin for a key component on the entire process, C.H. Robinson revisited each step of the process and developed a country-by-country standard operating procedure (SOP). The SOP documented the feasibility of the merge-in-transit process and which process steps needed to be followed for each destination country. The success of C.H. Robinson’s proposal included three key benefits to its customer: 1. Driving transportation costs out of the customer’s supply chain by routing products directly to their customers and moving final system assembly closer to their customer base, 2. Allowing C.H. Robinson’s customer to recognize the sales of systems outside of the U.S., which created significant tax benefits and supports the customer’s regional headquarter status in Asia, and 3. Allowing its customer to deliver completed systems duty free in every country versus delivering individual components separately. Some of the individual components were subject to import duties and this process change represented a significant cost advantage. Based upon C.H. Robinson’s proposal, the customer awarded the merge-in-transit contract to C.H. Robinson in 2007.

C.H. Robinson Worldwide Asian Operations Summary

Over the past 10 years, C.H. Robinson has significantly extended its Asian network and global supply chain management capabilities. By working closely with customers such as Tetra Pak, TMC is now managing transportation networks in most major global markets. The level of sophistication shown in building its customer’s merge-in-transit network solution is a good example of designing an optimal transportation solution, which generates significant efficiencies and cost savings for customers. This innovative thinking and hands-on transportation management process engineering has been a driver of C.H. Robinson’s growth in North America and seems to be transferring well to Asia.

Sources: A&A Primary Research, http://www.chrobinson.com/