FOR IMMEDIATE RELEASE

U.S. and Global Third-Party Logistics Market Analysis is Released

STOUGHTON, WI, May 21, 2009 – After 11 modest months in 2008, third-party logistics revenues dove in December and have remained depressed in 2009. While a few third-party logistics providers (3PLs) could drown, most are treading water and some are swimming strongly.

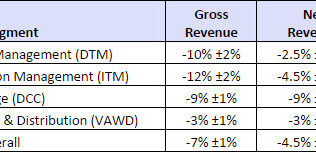

Our recent survey and analysis shows gross revenue (turnover) for 3PLs down by 8.8% for 2009. Net revenues (gross margins) were less impacted for many non-asset transportation managers and leading value-added warehousing 3PLs.

Expeditors, C.H. Robinson, Kuehne + Nagel and other major transportation managers report net revenues decreased 3% to 10%. Earnings before interest, tax, depreciation and amortization (EBITDAs) and earnings before interest and tax (EBITs) fell proportionately. Additionally, net revenues are expected to be down another 5% this year for the transportation management group.

In a recent survey, for 3PLs as a group 60% are reporting lower gross and net revenues for this year. Among value-added warehousing 3PLs, 57% are reporting increased net revenues. Automotive and retail vertical industries were the main drags on 3PL market growth for 2009 with projected revenues down 32% and 23% respectively. The food and grocery vertical and 3PL returns management subsegment are up for the year. GENCO, Kenco and New Breed expect revenues to increase in 2009.

Table 1. Estimated Revenue and Net Income Reductions by 3PL Segment – 2009

2008 Results – U.S.

2008 could be remembered as “lackluster” or “it could have been worse.” Gross revenues for third-party logistics in the United States grew 6.7% in 2008. Net revenues grew 4.7% compared to 7.2% in 2007 as the logistics part of the economy continued to slow before it dove in December. Combined EBIT for 3PLs was 8.9% of net revenue. Net income increased only 1.5% and was 5.3% of net revenue. Overall growth and the net profit ratio of 94.7 was the weakest since we began tracking it for FY1996.

Figure 1. U.S. 3PL Market 1996 – 2010E (US$ Billions)

We estimate that 2009 will be the first recorded negative year in 3PL gross revenue growth since we started tracking it in 1996.

The complete report is available from Armstrong & Associates online at: Guides & Market Research Reports.

About Armstrong & Associates, Inc.:

Armstrong & Associates, Inc. is a supply chain market research and consulting firm specializing in 3PL market research, provider benchmarking, strategic planning, mergers and acquisitions, logistics outsourcing, centralized transportation management programs, and supply chain systems evaluation and selection. Armstrong & Associates publishes Who’s Who in Logistics and Supply Chain Management – The Americas and Who’s Who in Logistics and Supply Chain Management – International. Recent research papers include Warehousing in North America – 2009 Market Size, Major 3PLs, Benchmarking Costs, Prices and Practices and Trends in 3PL/Customer Relationships.

For more information please contact:

Richard or Evan Armstrong +1-800-525-3915, or e-mail Dick@3PLogistics.com or Evan@3PLogistics.com.

Source:

Armstrong & Associates, Inc.

100 Business Park Circle, Suite 202

Stoughton, WI 53589 USA

Fax: (608) 873-5509

Website: www.3PLogistics.com